Say goodbye to the pause put in place by the Biden administration on student debt collection.

Student Loan Update: Trump Gives New Deadline for Garnishing Wages:

The Department of Education (DOE) announced Monday that it will resume collection efforts on defaulted federal student loans starting in May, ending a four-year pause initiated during the COVID-19 pandemic.

There are more than 40 million Americans with student loan debt, 5.3 million of whom are at risk of defaulting on their loans if the Biden-era payment pauses are halted, according to the Associated Press. Another four million are between 91 and 180 days late on their loan payments.

The move by President Donald Trump’s administration follows the expiration of payment pauses and grace periods that began in 2020 under the Biden administration and lasted through late 2024.

Beginning May 5, the DOE will restart involuntary collections through the Treasury Department’s offset program, which can withhold tax refunds, federal salaries, and benefits from borrowers with overdue loans.

After a 30-day warning, wage garnishment will also resume for those who are in default, potentially affecting millions of Americans.

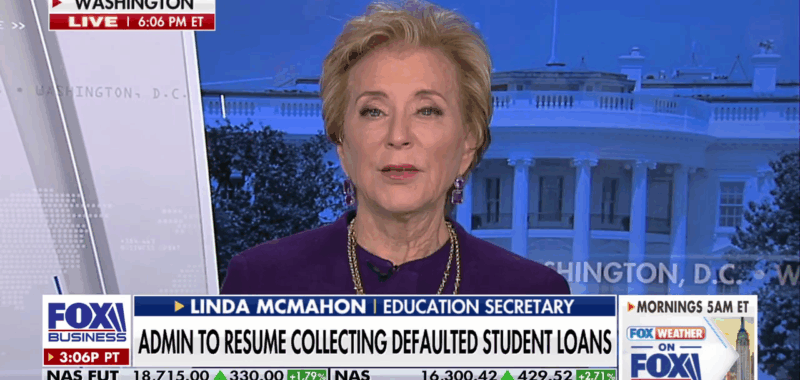

Trump’s Education Secretary Linda McMahon defended the move in an op-ed in The Wall Street Journal this week:

McMahon wrote in part on Monday, “Many of the degree-granting programs that qualify for student loans are worthless on the job market, but colleges continue to accept students to these programs and encourage them to borrow to pay for them. Accountability is a two-way street. As we push to hold student borrowers to account, we will also push colleges to be responsible and transparent.”

As of late 2024, outstanding federal student loan debt totaled around $1.64 trillion. The Biden administration forgave $188.8 billion in student loans for 5.3 million borrowers.

McMahon called this model “unsustainable” for students and taxpayers.

“Debt doesn’t go away; it gets transferred to others. If borrowers don’t pay their debts to the government, taxpayers do,” McMahon wrote.

McMahon made similar remarks during an interview on Fox Business Network this Tuesday, where she claimed that they’re “not trying to cause hardships” for anyone.

MCMAHON: We, we have announced that beginning May 5th, you must start to repay your loan and this is not to, in any way try to cause hardships.

There are several different payment plans that you can access if you go to, You know, StudentAid.gov, there are several plans there that can help you.

We also are keeping hours open longer at the service centers and also having them open on the weekend to answer any questions, and there will also be, AI help with Aidan who can answer many questions for you relative to your loans.

So we’re, we’re trying to, you know, to make it, easily accessible for responsible folks to pay back their loans, but they need to get on it because there isn’t going to be any loan forgiveness program.

FBN host Lisa Boothe asked McMahon if the federal government should “just get out of the student loan business,” and McMahon responded that they’re looking at it, but she thought it “requires more study.”

You know that’s where this is heading. They’re doing everything they can to harm people who are struggling in America, and jacking up interest rates for student loans by shoving all of it into the private sector falls right in line with the rest of their agenda.

If you’re MAGA and have unpaid student loan debt, or a child with unpaid student loan debt, I hope you’re happy with what you voted for last year. They have to pay for those tax cuts for the one percent somehow.